Overview:

This is a simple strategy to collect $150-400 with near zero risk.

For this strategy, you would need to be organized and detailed oriented to avoid pesky fees. The key is to find the right type of offer, because some banks will reward you handsomely for a direct-deposit with a few rules, while others expect a substantial deposit, which I do not recommend.

Once you meet the requirements, the bonus will be deposited to your account in 4-6 weeks. Its stated in the offer details. Then, rinse and repeat the process with another bank.

Please note that this cash bonus will be taxable as interest-income. (1099-INT)

Who should use this?

This income strategy would be ideal for someone who gets paid via bank direct-deposit and who is in a stable financial situation. I would recommend this for someone who meets the following criteria:

- Gets paid regularly by bank direct-deposit.

- In a stable financial situation (Has an emergency fund and has paid off high interest credit cards).

- Has some monthly disposable income left in the checking account. Has $500-1000 after monthly expenses,

How to do it?

Step 1: Find bonus offers.

Currently there are several excellent sites that list bank offers on a monthly basis. I would recommend the following sites:

https://www.bankrate.com/banking/best-bank-account-bonuses/

https://bankbonus.com/promotions/

Step 2: Select a suitable offer.

From the above sites, I would select an offer that meets the following criteria:

- Look for a bonus offer that is at least $150 or more. So it’s worth your time.

- Requires a Direct-Deposit instead of a large initial deposit. (Some offers require $10,000 or more to earn a bonus, I would stay away!)

- Learn what is required to avoid the monthly fee when you no longer send Direct-Deposits. Typically the bank expects you to maintain a balance of $500 or more to avoid fees. (The idea is change your Direct Deposit back to your old bank once you earn the bonus, but maintain the account for 6-12 months as a courtesy. Do read the fine print).

- Make sure the offer is not expired and available for your state of residency.

Step 3: Be organized!

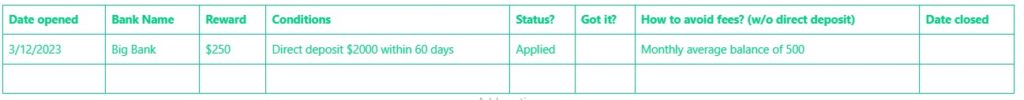

Have a spreadsheet to track the offers, their requirements, the bonus and the date the account is closed. Treat this like a game, where you follow a few rules and get the reward. Don’t let the details bother you, its part of the game.

Following is a spreadsheet that I utilize.

Step 4: Let’s open the new account

Open the account using the link from the above sites or make sure you use the offer code related to the bonus offer. (You will not earn the bonus if the “offer-code” or offer-link is not valid!)

The bank may require you to do an initial deposit of $25 or more. These funds can be transferred via ACH (Free bank to bank transfer) from your current bank account or paid via credit card. To setup ACH transfer, you would need to know the Bank Routing Number and Account number which is on the bottom of your bank checks.

>Remember to update the spreadsheet, to have a “Status” of “Opened”

Step 5: Meet the conditions!

Most likely the offer would require you to setup Direct deposit.

I would setup Direct Deposit at the source – meaning change the Direct Deposit settings from your employer, instead of asking the new bank to initiate the process. (If you forgotten where to change the Direct Deposit settings, you may have to check with HR or Payroll department. Once the changes are made it may take 10 or more days to activate.)

- As you change Direct Deposit to the new bank, you will have to make sure you have sufficient funds in your old bank to pay your bills, since your pay check will be going to the new bank.

- With the new bank, you would need to setup a bank to bank transfer (ACH) to send your funds back to your old account. This will help minimum disruptions, since you continue to operate your old bank as your primary.

Regarding ACH (Automated Clearing House) bank to bank transfers:

- Some banks limit, how much can be transferred on a daily basis. Some have low limits as $1000/day. Some allow $5000/day. Each ACH transfer takes 3-working-days.

- When ACH transfers are not practical due to transfer limits, you can use the “Bill Pay” feature and setup yourself as a Payee. Then setup a payment for yourself, where the bank will mail you a check to your home address. You can deposit it to your old bank account. (I make deposits from the mobile phone app, which makes it very easy!)

>Update the spreadsheet, to have a “Status” of “Met conditions”

Step 6: Get the bonus!

Finally, once you receive the bonus, celebrate! Then, update the spreadsheet “Got it” to Yes!.

Now, make sure you keep the minimum balance + $5 in the account to avoid fees and transfer/Bill-Pay the rest to your old account.

Change your Direct Deposit settings back to your old account.

Finally after about a year from the account open date, close the account and record the closed date and status as “Closed” in the spreadsheet. This also, allows you to collect minimum deposit that was tied up to avoid fees.

Happy Bonus Hunting!

Wealth Mechanic’s Personal Insights

- I have been using this technique since 2005 and have been doing it every year.

- The largest bonus reward I have received is $500 and $400 from several banks. Thank you CapitalOne and KeyBank. There used to be great offers back in 2009 and 2020, when banks open new branches and wanted new deposits.

- If both you and your spouse have jobs that direct-deposit paychecks, you both can repeat it separately. The offers don’t limit it per household.

- I have opened and closed 20+ bank accounts over the years. I average $2000 for both me and my wife. That’s 2-3 offers of $400.

- I prefer credit card bonus offers to bank bonuses, since credit card bonuses are not taxable! But once I open too many cards, I switch to opening bank accounts. (See “Let Credit Cards Pay you for opening accounts)

- Banks don’t consider you a “previous customer” after 2 years – so you can apply again to the same bank offer after 2 yrs. This is why it’s important to close the account. (After 2 yrs, you become a “new customers”).

- I use CapitalOne as my primary bank account and have been very please with their features.

- I use this money as “fun-money” to spend on “extra vacations” and “flight upgrades”, so I don’t feel guilty for splurging.

Please share questions and feedback in the comments below. Thank you!

2 Responses

good read

great